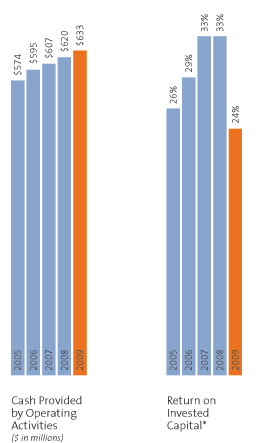

*The Company calculates return on invested capital (ROIC) as net income excluding after-tax interest expense, divided by the average of invested capital at the beginning and end of the fiscal year. Invested capital is calculated as the sum of total shareowners’ equity (excluding defined benefit accounting adjustments impacting accumulated other comprehensive loss) and total debt, less cash and cash equivalents.

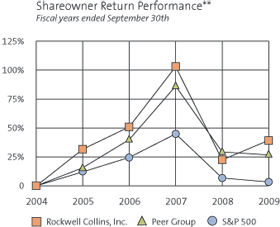

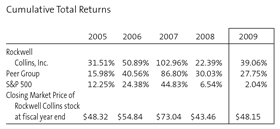

**The cumulative total return table and adjacent line graph compare the cumulative total shareowner return on the corporation’s Common Stock against the cumulative total return of the S&P 500—Aerospace and Defense Index (Peer Group) and the S&P 500—Composite Stock Index (S&P 500) for the five-year period ended October 2, 2009, in each case a fixed investment of $100 at the respective closing prices on September 30, 2004, and reinvestment of all cash dividends.

As I reflect upon the past year, I am again reminded how the fundamental strategies on which we have based this company—the balance between our commercial and government businesses, the diversity of our customer base and product offerings, and our shared services business model—continue to serve us well.

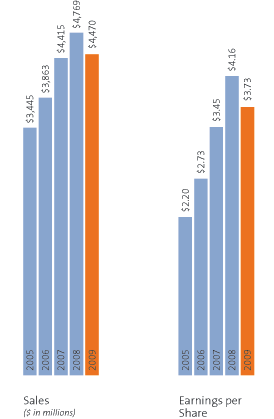

This past year presented the world with historic economic challenges. Beginning early in the fiscal year, we began experiencing steadily increasing weakness in all components of our Commercial Systems business that has only now begun to show signs of stabilization. Despite significant effort to adjust to market conditions, we ended fiscal year 2009 with a six percent decline in revenue to $4.47 billion and a 10 percent reduction in earnings per share to $3.73. Yet through all of this, there were some bright spots.

We generated total segment operating margins of 21.4 percent, only 50 basis points lower than 2008. And we delivered operating cash flow of $633 million—a record for our company. That cash flow, coupled with the strength of our balance sheet, allowed us to pursue acquisitions in important strategic growth areas and invest 19 percent of sales in research and development.

While our commercial business sustained the most significant impact from the economic downturn, we benefited from growth in our government business that partially offset this decline. Commercial Systems revenues fell 21 percent during the same period that Government Systems revenues grew nine percent, including growth from our recent acquisition of DataPath, a leading provider of satellite communication systems for military and commercial customers around the world.

Although the economic recession and its impact on commercial aerospace markets was outside of our control, I believe we have done what was needed to weather this storm.

During the past year, we sized our infrastructure and spending to market realities. We reduced controllable costs by prioritizing discretionary spending, cancelling salary increases, not paying incentive bonuses, and putting in place actions to close our San Jose, California facility. We also managed staffing levels through attrition, deferred or eliminated open employment requisitions, and reduced our workforce by about five percent.

Although there is still risk and uncertainty in our markets, we are beginning to see signs of general economic recovery—and as a result of our efforts in the past year, I believe Rockwell Collins is well positioned to enjoy the benefits of that recovery. Here’s why:

The market share we’ve won over the last five years did not evaporate with the weak economy.

Our positions on the Boeing 787 Dreamliner and the Airbus A350XWB—representing more content than we have ever had on a platform from either company—remain intact as these programs move toward entry into service. These long-range, fuel-efficient aircraft represent the next generation of air transport technology—and are highly anticipated by airlines around the world looking for ways to reduce costs and carbon emissions.

At the same time, we’ve been extremely successful at expanding our market share on new business and regional aircraft. Since 2001, we have participated in 22 head-to-head competitions for new business jet avionics positions —and Rockwell Collins has won 21 of them. Nine of these platforms are currently in development for entry into service through 2014.

Our latest avionics system, Pro Line Fusion™, has been selected by customers around the globe, such as Cessna, Bombardier, Embraer, Gulfstream and Mitsubishi. This advanced system’s flexible architecture provides high reliability with extensive growth capabilities to meet anticipated future airspace requirements. We continue to invest significant resources in the development of this system as we progress toward certification of the initial platforms in 2010.

Our Venue™ cabin electronics system has also earned positions on new aircraft, and will make its debut in 2010 on the Beechcraft King Air 350i and Cessna CJ4. This scalable system enables passengers in all classes of business aircraft to be connected and productive en route to their destinations.

Government Systems uses many of the same technologies found in the commercial segment. An example is the Common Avionics Architecture System (CAAS) for rotary wing aircraft. Initially derived from a commercial platform and introduced to the Department of Defense in the Special Operations Forces MH-47G Chinook and MH-60L/M Black Hawk aircraft, CAAS is a fully integrated flight and mission management solution that enhances mission effectiveness. The capabilities of this system continue to be proliferated across U.S. and international military rotary wing programs, including the German CH-53 and Canadian Maritime helicopters.

Years of development work on the Joint Tactical Radio System, which will deliver next-generation military communications capability for our warfighters, is nearing completion. We will continue to deliver pre-production units in fiscal year 2010 and begin production in fiscal year 2011.

All of these programs remain in high demand by our customers, and represent a strong foundation for growth.

We’re investing vigorously in our future.

Research and development expenditures in fiscal year 2009 were $848 million, and we are planning to increase our level of investment in fiscal year 2010, to a range of $870 to $900 million.

Clearly, our commitment to innovation and spending on future growth has not waned—and we believe this is our time to outpace competitors who are not as financially well-positioned to invest.

These expenditures in R&D are fuel for the ideas and creativity of our 6,200 engineers and knowledge workers at Rockwell Collins—and are a testament to a focus on providing innovative solutions to our customers.

For example, just as we introduced the next generation of avionics and cabin systems with Pro Line Fusion and Venue, we’re looking at ways to make Rockwell Collins a market leader in Information Management by providing connectivity for commercial aircraft and enabling net-centric operations across the military.

The company is also investing in new areas—like unmanned aerial systems, and communication and computational solutions for soldier and ground vehicle applications—as we continue to diversify our customer base. And we remain committed to growth through acquisition. This fiscal year we acquired U.K.-based SEOS, a leading provider of visual display systems, further expanding our offerings in simulation and training, as well as DataPath, which broadened and strengthened our offerings in networked communications, an area of rapid growth for military customers around the world.

All of these investments are key to maintaining existing market leadership, as well as enabling us to expand into new markets.

We’ve maintained strong relationships with our customers.

Customers ultimately judge us by our ability to build trust—and we know that every time we create a solution that brings value—we add to that level of trust. In thousands of dialogs with our customers we work together collaboratively and professionally to maintain and strengthen those relationships.

Trust is also created by doing what you say you will do. Our people take this responsibility very seriously and work hard to meet the commitments we make—one customer at a time.

We continue to focus on operational excellence through Lean ElectronicsSM.

Whether the challenge is managing inventory or driving efficiency in our processes, we’re taking advantage of Lean tools and thinking—and making them a way of life, throughout our company, to drive continuous change.

Lean allows us to shorten development cycle time, improve quality and on-time delivery, and provide enhanced functionality and increased value to our customers. Ultimately, our continued focus on Lean will also allow us to increase profitability for our shareowners.

One area of opportunity this year was asset management. By applying Lean principles across the enterprise and focusing on scheduling and planning alignment, we were able to realize a 27 percent year over year improvement in finished goods inventory. Our ability to obtain this level of improvement is particularly impressive given the significant volatility in our commercial business.

We are developing a talented and motivated workforce through a foundational strategy called our Value Proposition for People.

We support this strategy through a robust talent management process that involves everything we do to acquire, evaluate, reward and develop our people. We have a diversity program focused on enhancing our appeal to people with different backgrounds as they consider Rockwell Collins when making career decisions. We empower our employees with benefit choices that provide the flexibility to meet personal needs at every stage of their lives. And we have programs in place to enable current and future leaders to have the skills needed to be more effective.

New for fiscal year 2010 are a number of tools to assist our people with career development—whether they are growing within current jobs or growing toward different roles within the organization.

Our recently launched Rockwell Collins University will add a variety of new development opportunities—and ultimately provide the skills needed to help this company and our people achieve their full potential.

These initiatives help ensure that Rockwell Collins attracts, retains, and develops the talented and motivated people we need to win in an ever-changing world.

Looking ahead, I am confident that we are on a path to enjoy the benefits of economic recovery.

We renewed our focus on operational excellence, challenging employees around the globe to further streamline processes, eliminate waste and enhance productivity. We invested significantly in technologies that will enable our customers’ future success. We completed acquisitions that expanded our footprint in core and adjacent markets. Through teamwork, leadership and commitment, we are delivering on promises to our customers.

Fundamentally, the strategies upon which we founded our company—balance between our commercial and government businesses; diversity of customers and products; a level of integration that allows us to share technology and resources across portfolios; and a commitment to delivering results—will see us through the risks and uncertainties that remain in the markets and help us deliver long-term shareowner value.

My thanks to our employees for your dedication and shareowners for your confidence. With your continued support, we will emerge from this tough economic time poised for growth.

Sincerely,

Clayton M. Jones

Chairman, President and Chief Executive Officer